Senate Clears Senator Bramnick’s Bill to Fight New York State’s Unfair Tax Treatment

Senate Clears Senator Bramnick’s Bill to Fight New York State’s Unfair Tax Treatment

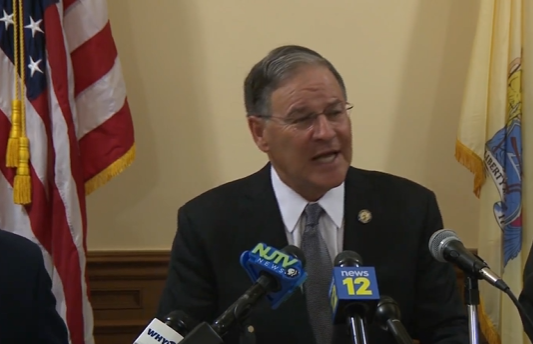

The New Jersey Senate approved legislation sponsored by Senator Jon Bramnick that combats New York State’s excessive and unfair taxation of New Jersey residents.

“Today’s Senate vote sent a clear message to New York State that we won’t allow our residents to be taken advantage of by out-of-state politicians,” said Bramnick (R-21). “Republicans in the legislature have been fighting for years to do something about New York’s heavy-handed tactics that abuse employees who live here but work for entities across the state line. This legislation is a good first step toward much needed reforms to end the current tax imbalance.”

New York aggressively taxes Garden State residents who are paid by New York employers. Taxpayers face generally higher tax rates, and although they receive a credit when they file as New Jersey residents, New York ends up keeping the revenue. Estimates indicate the cost to taxpayers could exceed $3 billion.

The stacked deck has become more obvious with technological advances and more people working from home and never setting foot in New York.

Senator Bramnick’s bill, S-3128 / A-4694, amends existing law to adopt a similar aggressive tax treatment for nonresidents who work for New Jersey employers.

The bill would additionally establish a pilot program overseen by the New Jersey Economic Development Authority (EDA) to incent New York businesses to assign New Jersey resident employees to locations within our state. Companies who are awarded grants under this program must commit to provide bonuses or increased compensation to their employees relocating to New Jersey offices.

Grants awarded under the program would not exceed $500,000 and a total of $35 million would be made available during the fiscal year for the purpose of funding the program.

“New Jersey is being played by unjustifiable policies that not only cost individuals and families money, but also rob the State of as much as $1 billion in revenue,” Bramnick noted. “We can no longer sit back and wait for New York leadership to do the right thing. State taxpayers deserve more consideration. This bill will make some changes and turn the tables in our favor and allow workers to hold on to more of their money.”