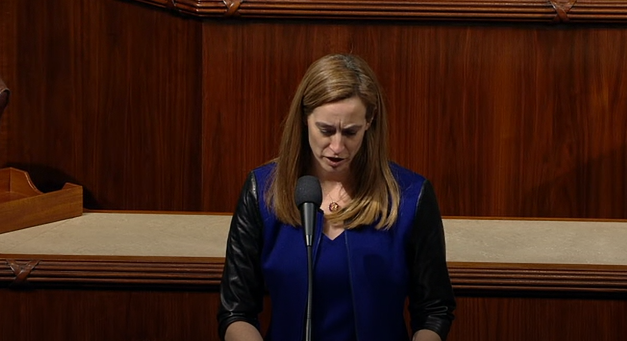

On Tax Day, Rep. Sherrill Blasts SALT Deduction Cap That Targets NJ Families

On Tax Day, Rep. Sherrill Blasts SALT Deduction Cap That Targets NJ Families

Parsippany, NJ — As Americans file their taxes before today’s deadline, New Jersey families are feeling the full weight of the 2017 tax bill. The $10,000 cap on the state and local tax (SALT) deduction disproportionately hurts residents in New Jersey’s 11th Congressional District, where the average state and local tax deduction is $19,000 – nearly twice the cap.

Families in New Jersey and across the country will lose out because of the cap. According to a Treasury Department audit released in February, nearly 11 million Americans will lose $323 billion in SALT deduction payments this year.

“New Jerseyans knew that the SALT deduction cap would hurt,” said Congresswoman Mikie Sherrill. “And now that we’ve reached Tax Day, I’m hearing constantly from residents who have to dip into savings to pay their tax bill, or ask how they can even afford to live in our state anymore.

“Our residents are part of the industrious and innovative economic engine that drives this country forward. Punishing them with the SALT deduction cap, limiting a deduction they and their families have relied on for decades, is wrong.

“There is bipartisan support in the House to address SALT, and I am going to continue to work with Republicans and Democrats to restore the full deduction. The House needs to immediately take up SALT legislation and get New Jersey taxpayer money back into New Jersey wallets.”

Representative Mikie Sherrill is leading the fight to restore the state and local tax deduction for New Jersey residents. She is a co-sponsor on H.R. 188, a bipartisan bill to restore the full state and local tax deduction.

###