Senate Bills Prioritize Help for Small Businesses During Covid-19 Crisis

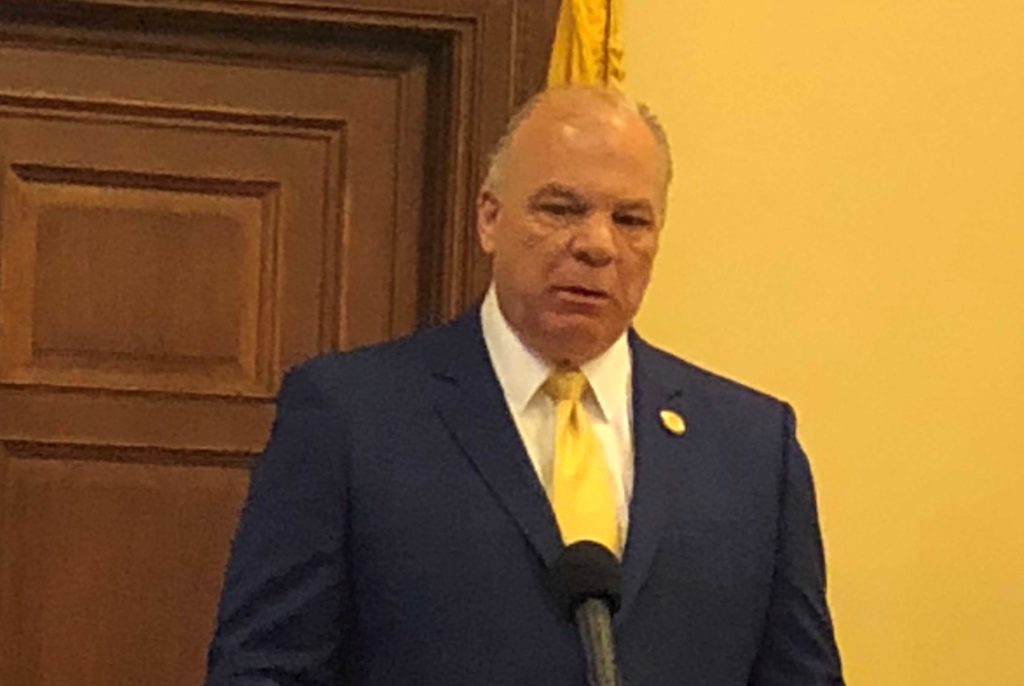

The Senate today approved two bills authored by Senate President Steve Sweeney and Senate Republican Leader Tom Kean that would provide tax credits and deferrals to small businesses confronted with economic turmoil caused by the coronavirus crisis.

One bill, S-2347, would establish the Business Related Tax Deferral Assistance Program, and the other measure, S-2348, would create a tax credit program at the state level modelled on the federal Employee Retention Credits in the CARES Act. The legislation is cosponsored by Senator Linda Greenstein and Senator Anthony Bucco. Both measures would target New Jersey’s small businesses with financial assistance that will help them and their employees withstand the economic impact of the coronavirus pandemic.

“The COVID-19 outbreak has confronted the state with an unprecedented public health crisis that is having severe economic consequences that are especially harsh for small businesses and their employees,” said Senator Sweeney. “We want to help keep workers on the payrolls and give businesses the assistance to withstand the economic consequences. A financial lifeline will help prevent the collapse of business entities and make sure business infrastructure is in place to support the recovery process after the current crisis has been contained.”

"This legislation is intended to help very small businesses to survive and recover from the severe economic impact of COVID-19," said Senator Kean. "Without a variety of relief efforts, including this legislation, many small enterprises will lack the financial resources to sustain the lengthy closure necessitated by the current pandemic. With so many businesses at risk and so many jobs at stake, we need to provide all of the support we can."

The tax credit bill would provide businesses experiencing economic hardship as a result of the COVID-19 outbreak a credit against their New Jersey corporation business tax or their gross income tax liability for wages paid to eligible employees. The credits would be available to businesses that are eligible to claim the federal Employee Retention Credit that was recently established by the federal Coronavirus Aid, Relief, and Economic Security Act.

The tax credit for employers would be equal to 20 percent of the federal credit for each employee, with a maximum state credit of $1,000 per employee. The credit will encourage businesses to keep employees on their payrolls, despite experiencing economic hardship.

The tax deferral bill would allow small businesses to defer payments for the sales, the motor fuels tax, the petroleum products, the income tax, as well as contributions for workers' compensation, unemployment, temporary disability, and family leave. The deferrals would provide businesses with access to cash to continue to meet payroll, purchase goods and services from suppliers, and other vital business costs.

“The deferrals will give small businesses some breathing room to help them make it through the financial crisis,” said Senator Greenstein. “Most importantly, it will help to keep their workers on the payrolls and prevent job losses.”

"Many small business owners treat their employees like extended family, and the thought of needing to lay people off that they care about during such a difficult time is heartbreaking," said Senator Bucco. "This legislation will provide a little extra financial support to help small businesses to keep their employees on payroll. That's extremely important right now, especially when so many New Jerseyans are having trouble getting through to the State's overwhelmed Unemployment Benefits system.”

The bill would require all deferred payments to be paid to the state after the emergency over a two-year period, with 50% submitted no later than June 30, 2021 and the remaining 50% no later than June 30, 2022. The program, the Employment and Business-Related Tax Deferral Assistance Program, would be run by the Economic Development Authority. The EDA would publish an annual report to monitor and evaluate the implementation of the program and submit the report to the Governor and the Legislature.