Sweeney Counters with Seasonal Rental Home Tax, 1% Increase in Realty Transfer Fees

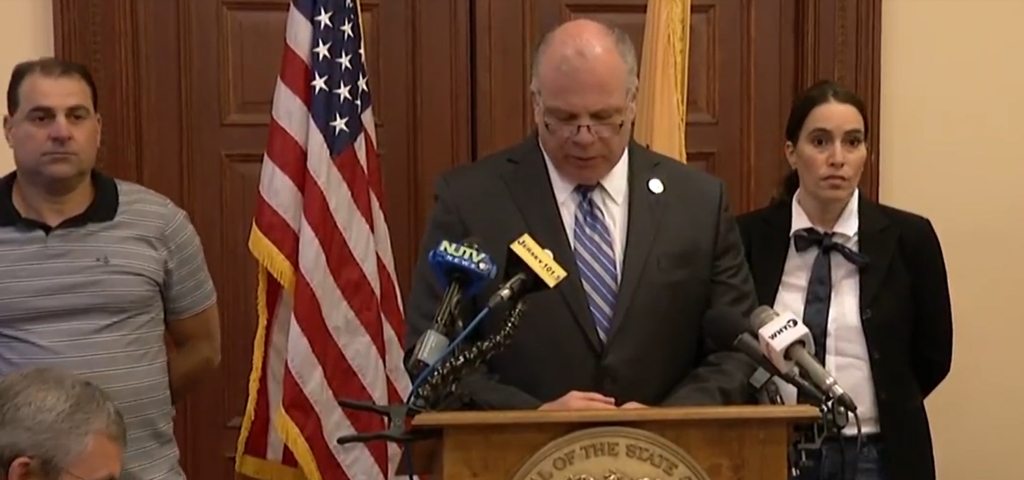

Uncomfortable with a millionaire’s tax and sales tax in this economic environment, state Senate President Steve Sweeney (D-3) today told reporters that he dug up millions in additional revenues requiring new taxes.

“If there’s a shutdown it’s because the Governor wants it and wants to raise taxes on people,” said Sweeney.

He unveiled some basic features of a new counter revenues proposal he says Speaker Craig Coughlin (D-19) also backs:

Shore rental tax:

$250 million.

Realty transfer fees:

$110 million.

“Right there is $360 million,” said Sweeney.

CBT adjustment

$68 million.

Ride sharing.

$6 million.

Wall Street bankers loophole.

Sales tax to internet sales and one-time repatriation of dividends.

He added it up.

His tally included some other measures already backed by Murphy.

$889 million – more than enough to close the budget gap.

A full itemization can be found below.

At the Statehouse press conference where he announced his proposals, the Senate President decried the Governor’s so-called compromise release yesterday as too reliant on a millionaire’s tax.

“We brought this forward for one reason: compromise,” Sweeney said. “I’m not for the millionaire’s tax. After Phil Murphy and I were reelected I tweeted support for a millionaire’s tax. What changed the game? Trump’s tax cuts changed the game. We had to hit the breaks. We are losing so many people. You’re paying 15% more in New Jersey than Pa. if you’re a millionaire. I voted for it five times, it’s just not the right time right now.”

Reconciliation of S2019

Could depreciate luxury values and the equity values of second homes in favor of local community banking.

Sweeney is a big disappointment. I knew murph was crazy but Sweeney should know better. Just getting another 1% from those leaving this state won’t help the overall economy and reputation of this state. They’re arguing whether they should gasoline or kerosene to burn this state down. Either way, the result is the same.