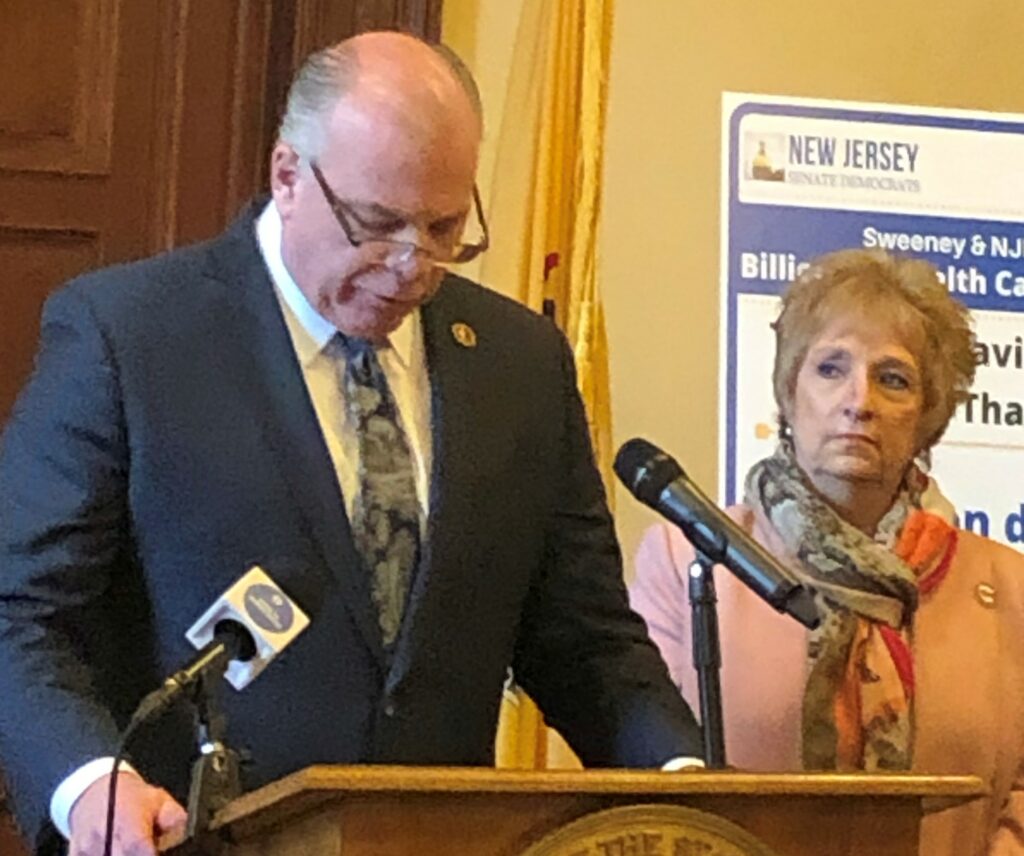

Sweeney Identifies Actions, Including Sales and Payroll Tax Holiday, to Provide Economic Relief from Impact of Coronavirus

Senate President Steve Sweeney today identified a series of actions both legislative and administrative that would help provide economic relief from the impact of the coronavirus pandemic. The initiatives would help mitigate the financial consequences of the public health crisis for New Jersey residents.

“Protecting the health and safety of the public is the top priority, but we should also take what actions we can to minimize the economic impact on individuals, families and businesses in New Jersey,” said Senator Sweeney. “The financial consequences can have a real and lasting impact on people and businesses across the state.”

Senator Sweeney said that actions could include a two month sales tax holiday for May and June, deferred property tax payments for 45 to 60 days, a 60-day deferral of sales tax payments for February and March, and interest-only mortgage payments.

Senator Sweeney said the actions could be taken by the administration, through legislation, or by the banking community.

“This is a crisis that calls on the cooperation of everyone in the public and private sectors,” said Senator Sweeney. “We know the pandemic will only get worse, so we should be prepared to address the economic fallout as well.”

Senator Sweeney said he will work with the Assembly and the Administration to develop the details of the initiatives, but said it is important to move forward with proactive polices.

Sweeney's Plan of Action:

1) Work in Person Waivers – There are a number of laws on the books that require certain businesses/professions (pharmacists in particular) to conduct business in person. This would provide a temporary waiver during the current emergency so folks can do more work remotely with fewer person-to-person contacts. - Legislative

2) Small Business Sales Tax Remittance Reduction – The economic fallout from the current emergency will fall especially hard on small businesses that rely on in-person interactions. This would allow those businesses that maintain or increase their FTE employees and wage levels to retain a percentage of the sales taxes collected from customers during and immediately after the emergency. - Legislative

3) Payroll Tax Holiday – A break provided by the State would help to put more money back in the pockets of employees and employers. - Legislative

4) Tax Deadline Extension – The federal government has or is considering extending tax filing deadlines and waiving certain penalties and interest for late filings/payments. The Director of the Division of Taxation in New Jersey has similar powers to do the same in New Jersey. - Administrative

5) Permit and Rule-making Extensions – Similar to previous downturns, permits and rule-making are particular concerns. A temporary extension should be implemented for previously issued permits that were expected to expire during the current emergency. Extending all rule-making timelines beyond this public health crisis also makes sense. It would be helpful to have a commission formed that would have the express purpose of approving permits on an expedited basis when the current emergency ends. This would help in getting the economy going when the current emergency ends. - Administrative/Legislative

6) Provide additional resources to Business Action Center Hotline – Heavily promoting and adding additional resources to beef up the BAC hotline that is vital for small businesses. The hotline should be a point of contact for business owners and give them an outlet to raise concerns and bring forward questions that may not be answerable otherwise. It is important for businesses to have a place where they can turn. - Administrative

7) Business Credit for Quarantined Workers – Many businesses are likely to have workers who need to be quarantined during the current emergency. The State develop and offer a CBT/GIT credit for businesses that continue to pay their employees while quarantined because of an outbreak. - Legislative

8) Temporary Extension of Unemployment Benefits – During previous recessions, the federal government and state governments have temporarily extended unemployment compensation benefits. Some extensions took into account state economic conditions. This is a tried and true method of boosting an existing program to get money into the hands of the people who need it most so that it can quickly begin to circulate. This time around the State has the added benefit of a UI trust fund that is much improved. According to current budget publications, the FY 2020 Unemployment Compensation Fund year-end closing balance is expected to be $3,335,370,889. - Legislative

9) Reallocate Resources to Unemployment Processing - Direct all available state employees to assist with the processing of increased unemployment applications to ensure that all payments can be expedited. - Administrative

10) Nutritional Assistance Benefit Enhancements – A number of good government groups including the Center for Budget and Policy Priorities have recommended increasing access or boosting benefits through existing nutrition assistance programs like SNAP or free and reduced school breakfast/lunches. The proposal would be to increase State spending on these programs on a temporary basis to increase the pool of people who are eligible or increase the amount of the eligible benefit individuals and families are able to claim. The same enhancements could be recommended for General Assistance and Emergency Assistance benefits because the increases would deliver assistance quickly to people struggling to get by who will spend virtually all of the additional resources they receive – that is, low- and middle-income households, who spend most of the income they have. - Legislative

11) Sales Tax Holiday – During prior downturns, different proposals have been floated to enact a temporary sales tax holiday as a way to encourage consumer spending and stimulate the economy. Similar legislation could be drafted to create a temporary tax break when the emergency recedes as a way to induce consumer spending. - Legislative

12) Protect Workers and Consumers by Limiting Returns - For good reason, many consumers have decided to stockpile food and supplies in the event of being quarantined. However, stores cannot determine what exposure many of these products may have had and therefore for several months following the end of the public health crisis supermarkets and grocery stores should suspend receiving returns of any product that could result in the continuation of the spread of disease. - Administrative/Legislative

13) Utilities Should Waive Late Payment Fees - While we applaud utilities for ensuring people access during this unprecedented pandemic, utilities should also waive late fees. Many people's paychecks will be temporarily interrupted, or worse, people will be temporarily unemployed and utilities should waive late fees for the next several months.