Legislation to Fix NJ's Fiscal Crisis, Pension System and Cut Property Taxes Unveiled

Listen to audio version of this article

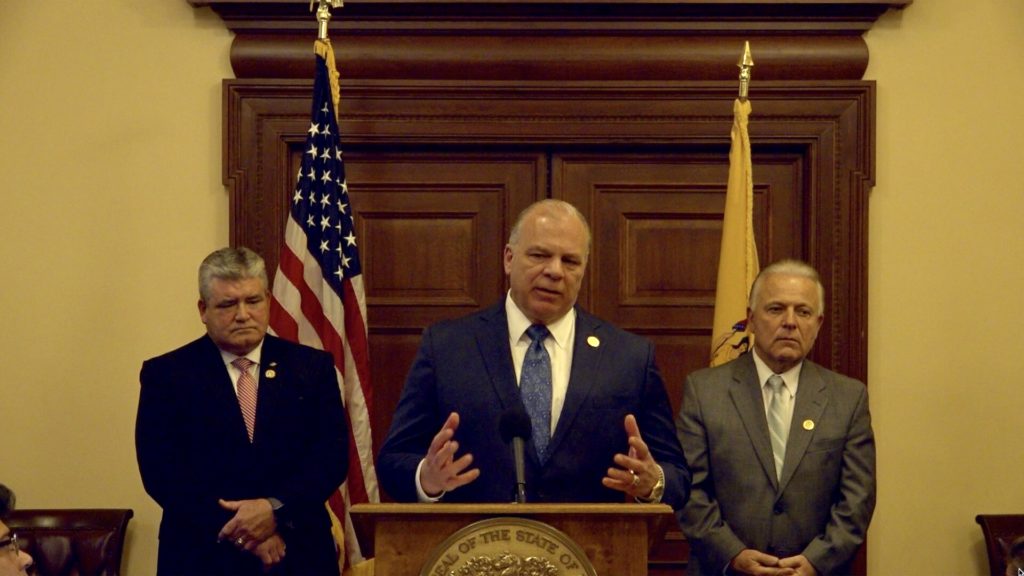

Trenton — Senate President Steve Sweeney, Senators Paul Sarlo and Steve Oroho and Assembly Majority Leader Lou Greenwald today unveiled a package of “Path to Progress” bills designed to fix New Jersey’s fiscal crisis, restore the stability of the pension system and save tens of billions of dollars for taxpayers.

“The Path to Progress is the path to real, sustainable tax relief in a state with the highest property taxes, the second-largest unfunded pension liability, the second-worst credit rating, and the fifth-highest overall tax burden in the nation,” said Senator Sweeney (D-Gloucester/Salem/Cumberland). “These reforms can have an historic impact that will produce an unprecedented amount of sustained savings. They will help make New Jersey more affordable, especially for hard working middle class families.

“If we fail to act, property taxes will continue to go up, and pension, health benefits and debt service will continue to eat up every penny of state revenue growth over the next three years, crowding out our ability to make the investments we need to make to increase aid to growing school districts, expand preschool, fix NJ Transit, make college affordable and provide funding for social service programs that serve our most vulnerable citizens,” he said. “We need to have the courage to make the right decisions and take the actions that are best for New Jersey’s future.”

The legislation introduced today was developed by the bipartisan Economic and Fiscal Policy Workgroup of economists, academics, government experts and legislators put together by Senate President Sweeney and chaired by Senate Budget Chair Sarlo (D-Bergen), Republican Senate Budget Officer Oroho (R-Sussex/Warren/Morris) and Assembly Majority Leader Greenwald (D-Camden).

Among the 27 bills are measures requiring the:

- Creation of a hybrid pension plan for teachers and non-uniformed state, county and municipal employees. The plan protects those with over five years of service who have a non-forfeitable right to their current benefits. It creates a new hybrid plan for new hires and newer employees that provides a defined benefit plan on the first $40,000 of income and a “cash balance” account on income above $40,000 that pays a guaranteed 4% return or 75% of the amount the pension system earns on their account. Any excess earnings would remain within the Teachers’ Pension and Annuity Fund and the Public Employees Retirement System to reduce the unfunded liability.

- Merger of the high-cost School Employees Health Benefits Plan into the State Health Benefits Plan to be run by an expanded Plan Design Committee, and the shift of all public employees from Platinum-level healthcare plans to Gold plans with an actuarial value of no more than 80 percent upon the expiration of current contracts. Public employers would be required to offer Bronze level plans with an actuarial value of 60 percent to employees with zero premium payments.

- Require county school superintendents to develop regionalization plans to merge all K-4, K-6 and K-8 districts into K-12 regional school systems, provide funding for regionalization studies, require all local school districts to coordinate both curriculum and schedules with the regional high schools to which they send students, and set up a pilot program permitting the establishment of countywide school districts.

- Require the state to administer and assume the cost of all Extraordinary Special Education placements above $55,000, replace the use of census-based reimbursement for special education costs with reimbursement based on actual pupil costs, and assign and train a cadre of Administrative Law Judges to handle all special education cases.

- Provide state funding for counties to appoint coordinators to expand shared services, require cost-benefit analyses for long-term tax abatements and mandate that future Payments in Lieu of Taxes (PILOTs) be shared proportionately with school districts and counties, and establish an Economic and Fiscal Policy Review Commission and a County and Municipal Study Commission within the legislative branch to continue to find efficiencies in government services and costs.

“Some of these are common-sense solutions that will help restore fiscal stability and responsibility to public finances,” said Senator Sarlo. “We have to make the reforms needed to allow state and local government to serve the needs of the public but we also have to find savings so that we can afford to fund our priorities. We have already shown that we can find efficiencies in the way health benefits are managed, and we did it in a way that reduced costs for government as well as employees. We encourage all stakeholders to join us in having serious discussions on how we make government better for everyone. ”

“This is a significant step in our efforts to solve New Jersey’s fiscal crisis and secure a better, more affordable future for taxpayers,” said Senator Oroho. “Our first line of defense shouldn’t be to raise taxes, especially when there are more fiscally-responsible options on the table that can reasonably control government costs. Together, in a bipartisan fashion, we have generated a comprehensive package of about 20 bills that eliminates the need for new taxes, while making every level of government more cost-efficient at the same time. I often say it has taken us years to create the fiscal mess we find ourselves in, so it will take time and discipline to rectify it. These ‘Path to Progress’ initiatives will pave a sustainable fiscal path going forward, provide real property tax savings, and I am pleased to see us moving forward on this plan today.”

“I’m proud we brought a group of people to the table to have an open and honest conversation about the health of our state and the policies needed to reduce costs, create efficiencies, and provide relief to the taxpayers of New Jersey," said Co-Chair, Assembly Majority Leader Lou Greenwald. “The Path to Progress allowed us to have a conversation about the long term fiscal health of our state. I applaud all the members of the working group that volunteered their time to work on the task force and for bringing these issues to the forefront. I look forward to reviewing the legislation with the Speaker and our Caucus.”

Towns have been sharing services since the early 1990s. This is a BS idea. Just the legislators trying to put the onus on the towns instead of themselves. Also, why would you spend state money - which is still our money - to bribe towns to do what they have already done where it was possible????? Nonsense. Typical out of touch politicians. Dictate from the Dome. Damn the consequences! The only solution to property taxes is to overturn the Abbott decisions and stop sending $6 billion of our money down the ratholes of 31 school district. This is what is depleting our middle class and forcing us to leave.