Treasury Freezes Nearly a Billion Dollars in Spending as Fiscal Uncertainty Over COVID-19 Mounts

From the NJ Treasury:

Issues New Disclosure Statement on Potential Financial Impact

(TRENTON) – State Treasurer Elizabeth Maher Muoio issued a new voluntary disclosure statement to bond holders today, as required by law, providing the most detail, to date, on the potential impact COVID-19 may have on New Jersey’s finances, including revenue collections and pension fund contributions.

Among the notable items the statement discloses:

“The impact of COVID-19 on the State, its economy, and budget and finances is unpredictable and rapidly changing, but the State believes that events surrounding COVID-19 will negatively impact the State’s economy and financial condition.

“Some of the negative impacts that the State has currently identified include:

- The State expects precipitous declines in revenues in Fiscal Year 2020 and Fiscal Year 2021, which include significant reductions in gross income tax revenues, corporate business tax revenues, and sales tax revenues due to required business shutdowns, motor fuels taxes due to Executive Order No. 107 (i.e., “stay-at home” orders), casino-related taxes due to casino closures, and lottery sales which have already started to decline.

- The State expects that it will need to significantly revise the estimated revenues and projected appropriations for Fiscal Years 2020 and 2021 contained in the Governor’s Budget Message for Fiscal Year 2021 delivered on February 25, 2020, which was before the outbreak of COVID-19 within the State.

- The State expects to encounter negative impacts on its liquidity in Fiscal Year 2020 due to the expected extension of the State tax filing deadline from April 15, 2020 until potentially July 2020.

- It is possible that the State may encounter future increases in the State’s actuarially recommended contributions to the State’s pension plans to the extent that the valuation of pension plans is affected by the deterioration in value in the investment markets.”

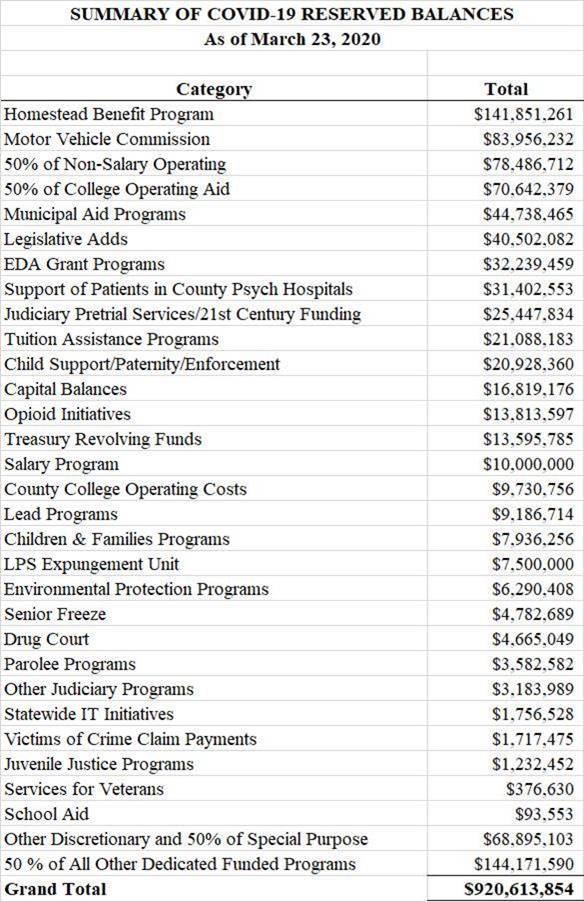

The disclosure statement also noted that the Director of the Office of Management and Budget on Friday placed over $900 million in items of appropriation into reserve in order to ensure sufficient cash and budget authority to meet emergency and statutorily required obligations.

Among the major items of appropriations placed in reserve is funding for the Homestead Benefit credit. The State is in the process of notifying towns that any credits intended to be applied to the May 1 bills can no longer be supported by the state at this time. The State is prepared to reimburse any municipalities for the administrative costs if they have to issue revised property tax statements.

A full list of appropriation items that have been placed in reserve spending freeze includes:

The disclosure statement concludes by noting, “It is likely that the full fiscal impact of COVID-19 on the State will change significantly as the situation further develops. The actual impact of COVID-19 on the State, its economy and its budget and finances will heavily depend on future events, including future events outside of the control of the State, and actions by the Federal government as well as nations across the world. The State believes that it may be some time before the State is able to determine the full impact that the various events surrounding COVID-19 have on the State’s economy, and its financial condition.”

[pdf-embedder url="https://www.insidernj.com/wp-content/uploads/2020/03/ER1318670-ER1027550-ER1434215.pdf"]