Welcome To the Land Of Lame Ducks

It was a gentle nudge rather than a crude shove, but the Legislature’s presiding officers moved Gov. Phil Murphy a tad closer to the Land of Lame Ducks by floating the prospect of extending the state’s corporate business tax surcharge to finance property tax relief.

The five-year-old 2.5 percent surcharge on businesses with taxable incomes over $1 million a year is scheduled to expire this year with the governor’s support despite growing pressure to keep it in place and direct the revenue toward new or expanded programs.

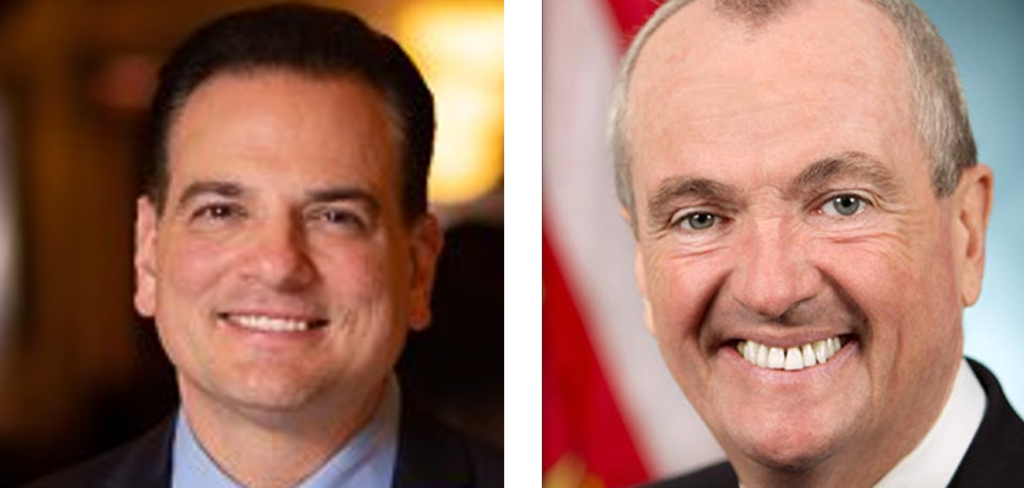

Assembly Speaker Craig Coughlin (D-Middlesex) has recommended a targeted property tax relief program benefitting senior citizens while Senate President Nick Scutari (D-Union) expressed his openness to continuing the surcharge to fund relief efforts.

The sunset of the surcharge is estimated to reduce state revenue by $322.5 million in the first half of 2024 and by $1 billion in fiscal year 2025.

Aside from naming his plan StayNJ and pledging to reduce seniors’ property tax bills by half, Coughlin has not offered details while Scutari’s receptiveness awaits discussions with the governor’s office.

The underlying message, though, is unmistakable ---- Murphy is two-thirds of the way through his two terms and, like all governors before him in the same situation, is experiencing a gradual weakening of his dominance.

He’ll not appear on the state ballot again --- unless in pursuit of a national office --- leaving legislators at the top of the ticket this year and running with a new gubernatorial candidate in 2025.

Murphy, in other words, is a non-factor and no longer commands a politically willing Legislature to embrace his agenda or risk losing support both organizationally and financially.

His promise to adhere to the tax surcharge expiration schedule was welcomed enthusiastically by the business community and touted by Murphy as a commitment kept.

The more cynical political observers suggest that Murphy hasn’t completely given up on national ambitions and establishing his bona fides as a tax cutter can advance those ambitions.

While it is a tad disingenuous since the surcharge was due to expire in any event, Murphy can rightfully characterize it as a tax cut, a promise kept and an example of his competent fiscal stewardship.

Coughlin and Scutari, though, are playing the long game, hoping to maintain and build upon Democratic majorities this year and solidify the party’s hold on unified government through 2025 and beyond.

A massive multi-billion dollar property tax relief program will serve those goals well, Murphy’s commitment notwithstanding.

It is in line, for instance, with traditional Democratic Party orthodoxy --- tax the rich, force business to pay its fair share, etc. --- and reap the electoral benefits of a grateful citizenry.

The Legislature’s budget committee is little more than a month away from the July 1 deadline for approval of a fiscal 2024 spending plan and with the leadership signaling support for continuing the surcharge, odds of following their lead are increasingly favorable.

Business leaders have warned that the impact of continuing the surcharge will be devastating, leading to disinvestment, lost opportunities and employment loss. The state’s corporate tax rate is already the highest in the nation, they point out, and continued economic growth will be stunted by an even greater tax burden.

Murphy, of course, is not without resources and clout --- diminished though they may be --- and could decide to launch a full court press in the Legislature to retain the surcharge or, in the extreme, exercise his line item veto authority to remove it from the budget and risk an override.

The reality, though, is that the tide of power has reversed, flowing away from the executive and toward the Legislature.

Appeals to party loyalty and reminders of past gubernatorial favors are no longer the dominant factors in executive-legislative decision making.

To outsiders, it may seem cold and ungrateful but politics is often a business with a super abundance of both characteristics.

Coughlin, for instance, is in the mix as a potential gubernatorial candidate with a solid base in increasingly influential Middlesex County. He’ll face formidable competition, though, particularly in the contest for an open executive seat, but his role as the principal player in extending massive property tax relief to seniors will be a signature accomplishment.

Murphy, of course, can view the conclusion of his term on the horizon and faces a decision on whether to fight to maintain the surcharge, give in to it as the will of the Legislature, or attempt to strike some compromise; a short extension or a reduction in the percentage, for instance.

He can also view the gates to the Land of Lame Ducks ahead, conscious of the gentle nudge applied by Coughlin and Scutari.

It’s in his best interest to recognize the message and avoid the crude shove.

Carl Golden is a senior contributing analyst with the William J. Hughes Center for Public Policy at Stockton University.

Governor Phil KNUCKLEHEAD Murphy, has been a disaster for New Jersey. What, with highest property taxes in the nation, and in the top 2-3 in income taxes and corporate taxes. Plus, Murphy's draconian anti-Second Amendment violations with his tyrannical anti-gun laws that made no one safe (all one has to do is look at the 5 worst cities in NJ for violent gun crime going up exponentially during Murphy's terms). The violent gun crime spilled out into the suburbs (the murder of a young lawyer in front of his wife at the Short Hills Mall during an armed car theft comes to mind), and what does Murphy do???? More "COW BELL" A/K/A more GUN CONTROL against the law-abiding and innocent, while ignoring the massive increases in crime and all the most violent crime metrics. Murphy's anti-Second Amendment drive, along with his complicit Democrat legislative criminals, constitutes criminal Official Misconduct, Pattern of Official Misconduct, and Official Violation of Civil Rights. It is outright Treason to the U.S. Constitution (2nd Amendment). If the Democrats under Coughlin and Scutari pass a massive property tax relief bill by using the corporate business tax surcharge, they may get re-elected. Then they must institute the de-coupling of education taxes from property taxes, and make everyone pay their FAIR SHARE of education taxes through income taxes (as the NJ Legislature passed the income tax for large property tax relief in the 1970s, but then proceeded to blow the income tax on every other social welfare program and Democrat pet project out there). Otherwise, it's another lie, and dog and pony show by the Democrat legislators during an election cycle. New Jersey voters should not be fooled. They need to keep a close eye on these Democrats who claim "massive property tax relief" and continually call their offices to make it happen. When the politicians say "massive property tax relief", we New Jerseyans don't want to see a 10% cut in property taxes. That would be an insult and slap in the face to all New Jersey property owners. What "massive property tax relief" means is that ALL property taxes in NJ must be cut by at least 50%, or 2 full quarters of property taxes--PERMANENTLY!!!!. Anything less would be considered as tax fraud by NJ Democrat legislators, who are using the property tax relief monies for wasteful programs and pet projects.

A budget over ride requires 2/3 vote in both houses. Democrats lost a super majority in 2021. Therefore an attempt - for the first time - to over ride a Murphy veto of increasing the CBT would require every Democrat as well as multiple Republican's to vote for the reimposition of the tax increase. I am not certain Scutari and Coughlin could get 100% of their own caucus to vote for a tax increase 5 months before an election. The chances they could get GOP members to join them to vote for a tax increase feels like nil.