Breaking Down the Murphy FY2021 Budget Address

TRENTON - Phil Murphy made it sound pretty darn easy.

"There is no better alternative than a millionaire's tax," the governor said in his budget address today.

Many of the large assemblage of Democrats applauded; as did many in the gallery, which was packed with administration officials and fans.

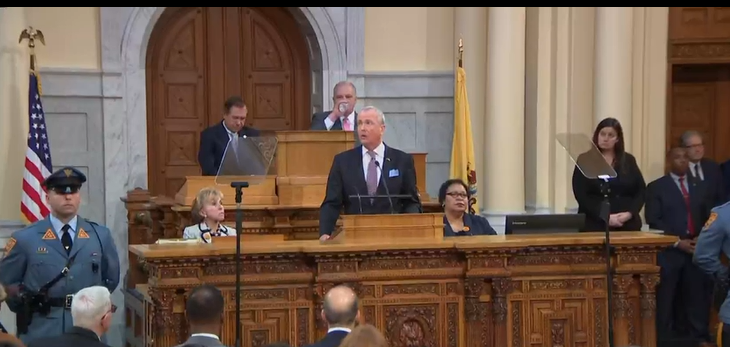

But Senate President Sweeney and Assembly Speaker Coughlin, who stand behind the governor during these events, didn't join in on the fun. In that way, they were more like Republicans who reflexively oppose just about any tax increase.

In press reports prior to the speech, there were indications Sweeney would be amenable to increasing taxes on millionaires. But his public demeanor didn't jibe with that position. Keep in mind that the tax failed the last two years because of opposition from Sweeney and Coughlin.

In truth, the plan is not outrageous. Polls long have found public support for it. No surprise there, given the fact people are prone to support a tax that doesn't impact them. And most do not earn a million dollars a year.

Right now, the top income tax rate in New Jersey is 8.97 percent. The proposal would increase that rate on those earning $1 million or more a year to a high of 10.75 percent. The governor said the increase is only about two percentage points, or two cents on a dollar of income above a million.

Fair enough. But spun another way - and politics is all about spin - the percentage increase of going from 8.97 to 10.75 percent is almost 20 percent.

You got the feeling in the last two years that Sweeney and Coughlin were leery of raising taxes in general regardless of how the actual increase boiled down.

The governor talked about the increase as a matter of fairness, declaring it a "myth" that a millionaire's tax would drive people out of New Jersey. People are, of course, migrating from New Jersey but whether the income tax is to blame is a matter of debate.

But what definitely is making New Jersey no longer affordable for some are property taxes. And Murphy suggested that one way to control property taxes is through the millionaire's tax.

He proposed using most of the $500 million raised through the tax for property tax relief, primarily through increased school aide.

"School funding is property tax relief," the governor said - more than once in fact.

Maybe.

Here's the problem. Consider a school district receiving $500,000 in additional state aid commencing with the 2020-21 school year. The district could put that money on the revenue side of the budget, which does indeed reduce the amount of property tax money to be raised.

But it also could use that money to expand programs, curriculum or hire more staff. Those can be sound education decisions, but they don't necessarily reduce property taxes.

As odd as it seems, the state can't do all that much about property taxes, barring a constitutional convention to radically change how public education is funded. The governor acknowledged as much, noting that the state does not set property taxes; that's done by local governments, primarily school districts, county freeholders and municipal governing bodies.

But no governor can afford to ignore the problem. Besides the tax on high-earners, Murphy this year mentioned - he failed to do it last year - the team of Platt and Glatt. That would be Republican Nic Platt and Democrat Jordan Glatt, two former mayors working to promote shared

services among towns and school districts. The men have been given the highly un-democratic title of "shared services czars."

Republicans were not impressed with Murphy's budget address, nor with his pitch to use a higher tax for property tax relief.

But, in truth, it's Sweeney and Coughlin who matter. And we have about four months to see how this latest play turns out.

The feeling here is that Murphy ought to drop the property tax relief argument, simply because it's not necessarily true more school aid would reduce taxes.

He'd do better selling the idea as a way to expand what he wants his administration to stand for - fairness.

Celebrate Leadership, Service & Sisterhood at the 2025 Peg Roberts Volunteer Awards Luncheon Hosted by the New Jersey Federation of Democratic Women (NJFDW)

Celebrate Leadership, Service & Sisterhood at the 2025 Peg Roberts Volunteer Awards Luncheon Hosted by the New Jersey Federation of Democratic Women (NJFDW)